Crime Pays. At least this seems to come true for cyber criminals who have managed to cause huge losses to both nationalized as-well-as private banks of the country over the years. Doing away with all the measures adopted by financial institutions in the country to check cyber fraudsters from siphoning off hard earned money of citizens, the Nationalized and Private Banks in the country suffered a whopping over Rs 236 crore revenue losses in past four financial years to cyber crime.

As per the Reserve Bank of India (RBI), data on financial frauds was maintained by it under the category – “Cards/internet – credit cards, cards/internet – debit cards and cards/internet – internet banking”. Data of financial losses made available by different nationalized and private banks about the financial losses suffered at the hands of cyber fraudsters, the extent of loss (in cases involving Rs 1 lakh and above) during last four Financial Years (FY) was around Rs 236.37 crore.

Data revealed that in financial year 2020-21 banks suffered a significant Rs 50.10 crore revenue loss owing to cyber crime while during financial year 2021-22, the loss was estimated to be a significant Rs 80.33 crore. Further, in financial year 2022-23, the financial loss sufferened by banks was calculated to be Rs 69.68 crore while in financial year 2023-24 it is pegged at Rs 36.26 crore.

Customer to report of cyber crime to bank within three working days

To help customers recover loss on account of fraudulent transactions, the RBI has issued instructions on limiting the liability of customers in cases of unauthorised electronic banking transactions. In cases where the deficiency lies with the bank, customer will not bear any loss if the customer reports such incident to the bank within three working days. However, customers will have to bear the loss where the deficiency lies with them.

Government policy to reimburse losses suffered by individual

In cases where the deficiency lies neither with the bank nor with the customer but elsewhere in the system and customer reports it to the bank within three working days of receiving information of unauthorised electronic transaction, the customer would not have to bear the loss.

If the customer reports unauthorised electronic transaction within 4 to 7 working days where deficiency lies neither with the bank nor with the customer but elsewhere in the system, liability of the customer shall range from Rs 5,000 to Rs 25,000 depending on the type of account.

If customer reports unauthorised electronic transaction after a gap of 7 working days, the liability of customer shall be determined as per the banks’ Board approved policy. In cases where the loss is due to negligence by a customer, any loss occurring after the reporting of the unauthorised transaction shall be borne by the bank. Further, the burden of proving customer liability in case of an unauthorised electronic banking transaction is on the bank.

National Cybercrime Helpline Number 1930

In order to facilitate citizens to report any cyber crime incident including financial frauds, the Ministry of Home Affairs(MHA) has launched a National Cybercrime Reporting Portal (www.cybercrime.gov.in) as well as a National Cybercrime Helpline Number 1930. Further, customers can also report financial frauds on the official customer care website or branches of the banks.

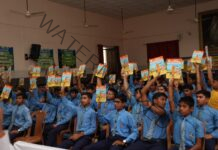

Initiatives to spread awareness against cyber-crimes

With an aim to spread awareness against cyber-crimes, the Government has been taking various initiatives from time to time. These, inter alia, includes cyber safety tips through social media accounts, publishing of handbook for adolescents/students, publishing of ‘Information Security Best Practices’ for the benefit of government officials, organizing cyber safety and security awareness weeks in association with States/Union Territories etc.

In addition to these, RBI and Banks have also been taking awareness campaigns through dissemination of messages on cyber-crime through short SMS, radio campaign, publicity on prevention of ‘cyber-crime’. Further, RBI has been conducting electronic-banking awareness and training (e-BAAT) programmes which focuses, inter alia, awareness about frauds and risk mitigation.

Insurance cover for reimbursement of loss suffered due to cyber crimes

As per Insurance Regulatory and Development Authority of India (IRDAI) currently all major insurance companies were offering cyber insurance products to commercial entities including banks besides individual customers.

| Financial Year | Financial Loss (in cr) |

| 2020-21 | 50.10 |

| 2021-22 | 80.33 |

| 2022-23 | 69.68 |

| 2023-24 | 36.26 |

| Total | 236.37 |