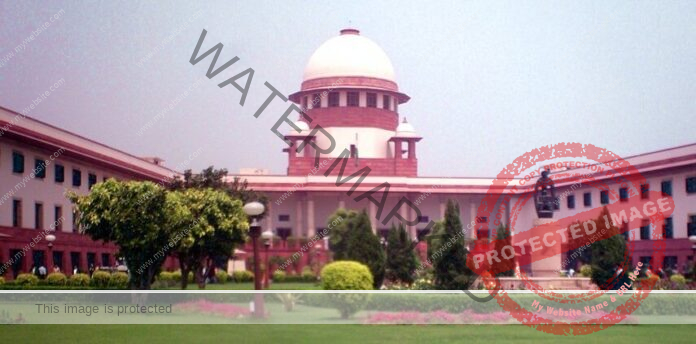

The Supreme Court on Thursday struck down the validity of Electoral Bond Scheme introduced in 2018 for the purpose of electoral funding.

A five-judge Constitution Bench of the Apex court scrapped the electoral bonds scheme, terming it ‘unconstitutional’ thereby putting an end to a controversial way of political funding that continued to be under the scanner since the very beginning.

The top court gave its verdict on the petitions filed against the validity of the electoral bond scheme. In its decision, the Supreme Court banned electoral bonds. Criticizing the Electoral Bond Scheme, the Supreme Court said that it was very important to get information about the funding being received by political parties. Electoral bonds are a violation of Right to Information.

The donor’s name was also not revealed under the Electoral Bond Scheme which affected transparency in political funding. During the nearly six-year period since the scheme was launched, General Elections 2019 were held besides a total of 45 state assembly elections also took place.

Supreme Court asks SBI for complete information

The five-member Constitution bench headed by Chief Justice of India DY Chandrachud bench and comprising of Justice Sanjiv Khanna, Justice BR Gavai, Justice JB Pardiwala and Justice Manoj Mishra gave a unanimous verdict on the case. In its decision, the Supreme Court has ordered SBI Bank to provide complete information about electoral bonds from 2019 till now. Judge Sanjiv Khanna, in the judgement, stated that 94 per cent of the value of donations came from electoral bonds of Rs 1 crore donations which indicated the ‘quantum of corporate funding’.

The five-member Constitution bench headed by Chief Justice of India DY Chandrachud had reserved the verdict in the case on November 2 last year, which was pronounced today.

Electoral Bond Scheme

The scheme was notified by the government on January 2, 2018. According to this, electoral bonds could be purchased by any citizen of India or any entity established in the country. Any person could purchase electoral bonds either singly or jointly with other persons. Such political parties registered under Section 29A of the Representation of the People Act, 1951 are eligible for electoral bonds. The only condition for receiving such bonds is that the party should have got at least one percent votes in the last Lok Sabha or Assembly elections. Electoral Bonds could be encashed by an eligible political party only through its account with an authorized bank.

The Apex Court judgement stated that a major portion of donations through electoral bonds had been received by political parties in power at Centre as well as in states.

FUNDING OF PARTIES THROUGH ELECTORAL BONDS/DONATIONS (IN CR)

| PARTY | 2022-23 | 2021-22 | 2020-21 | 2019-20 | 2018-19 | 2017-18 |

| BJP | 1294.1499 | 1033.7 | 22.385 | 2555.0001 | 1450.89 | 210.00 |

| INC | 171.02 | 236.0995 | 10.075 | 317.861 | 383.26 | 5.00 |

| AITC | 325.10 | 528.143 | 42.00 | 100.4646 | 97.28 | — |

| BJD | 152.00 | 291.00 | 67.00 | 50.50 | 213.50 | — |

| DMK | 185.00 | 306.00 | 80.00 | 45.50 | — | — |

| BRS | 529.037 | 153.00 | — | 89.1529 | 141.50 | — |

| YSRCong | 52.00 | 60.00 | 96.25 | 74.35 | 99.84 | — |

| TDP | 34.00 | 3.50 | — | 81.60 | 27.50 | — |

Meanwhile, an analysis report prepared by Association of Democratic Reforms(ADR) about donations (above Rs 20,000) received by 31 recognized political parties including seven National level parties besides the 24 Regional level political outfits between 2016-17 and FY 2021-22 revealed total donations received by 31 political parties during six-year period was Rs 16,437.635 cr. Donations worth Rs 9188.35991 crore were received from Electoral Bonds (55.90%), Rs 4614.53 crore were received from corporate sector (28.07%) and Rs 2634.74509 crore were received from other sources (16.03%).

Also, revealed the report, total donations declared by the seven National Parties and 24 Regional parties (from Electoral Bonds, corporate sector and other donations) between 2016-17 and 2021-22 was Rs 13190.685 crore (80.247%) and Rs 3246.95 crore (19.753%), respectively.

Crucial six-year period

This six-year time period is crucial, as during this time the Electoral Bond Scheme 2018 was introduced for the purpose of electoral funding as well as the Finance Act 2017 removed the previous limit of 7.5% of the company’s average three-year net profit for political donations. A company was no longer required to name political parties to which such contributions were made. The donor’s name was also not revealed under the Electoral Bond Scheme. The Government amended the Income Tax Act, the Companies Act, the Reserve Bank of India Act and also the Foreign Contribution (Regulation) Act 2010 (with retrospective effect) to allow foreign companies registered in India to contribute to political parties, revealed the analytical report.

It is also important to note that during this period, General Elections 2019 took place and a total of 45 state assembly elections were held.

Significant rise in donations from electoral bonds

Also for National level parties, there was a 743% increase in donations from electoral bonds between 2017-18 and 2021-22 while for corporate donations this increase was only 48%.

Further revealed the report, Electoral Bonds were the most preferred mode of donations for making contributions to National and Regional political parties amounting to Rs 9188.35991 crore, followed by direct corporate donations worth Rs 4614.53 crore.

BJP received three times total donations viz-a-viz all other National parties

The report reveals that the total donations declared by BJP was more than three times the total donations declared by all other National parties. During the six-year period, more than 52 percent of BJP’s total donations came from Electoral Bonds worth Rs 5271.9751 crore, while all other National parties amassed Rs 1783.9331 crore. INC declared the second highest donations from bonds of Rs 952.2955 crore (61.54% of its total donations) followed by AITC which declared Rs 767.8876 crore (93.27%) respectively.

Frurther more than 89.81 percent of BJD’s total donations came from Electoral Bonds worth Rs 622 cr. DMK declared the second highest donations from bonds of Rs 431.50 crore (90.703% of its total

donations) followed by TRS which declared Rs 383.6529 crore (80.45%) and YSR-Congress which declared Rs 330.44 crore (72.43%) respectively.

Direct Corporate Donations

As per the report, direct corporate donations between 2016-17 and 2021-22, the total direct corporate donations declared by National parties was Rs 3,894.838 crore while Regional parties declared Rs 719.692 crore. The direct corporate donations declared by seven National parties were more than five times the corporate donations declared by 31 Regional Parties during the six-year period

The corporate donations declared by BJP were at least three-four times more than the total

corporate donations of all other National Parties. In FY 2017-18, it was more than eighteen

times that of all other National parties.

However for the six-year period, BSP has consistently declared no corporate donations while CPI has declared receiving zero corporate donations from FY 2018-19 to FY 2021-22.

In the six-year period, direct corporate donations declared by Regional parties increased by

152.029 percent.

Between 2016-17 and 2021-22, Prudent Electoral Trust contributed the highest amount of

Rs 1604.43 crore followed by Progressive Electoral Trust (Rs 549.9750 cr) and BG Shirke

Construction Technology Pvt Ltd. (Rs 102.155 crore) respectively.

Delhi – Maximum Corporate Donations

The maximum corporate donations, revealed the report, declared by the 31 recognised political parties came from Delhi amounting to Rs 1843.697 crore followed by Maharashtra (Rs 1418.130 crore) and Gujarat (Rs213.540 crore).