Firing on all cylinders and leaving no feather of the government unruffled, Leader of Opposition (LoP) Rahul Gandhi made serious allegations against the Securities Exchange Board of India (SEBI) chief’s connect in Adani money laundering scam saying that that common investors in the Indian stock market were at risk. “Investment is at risk because those who regulate the stock market are compromised,” he said.

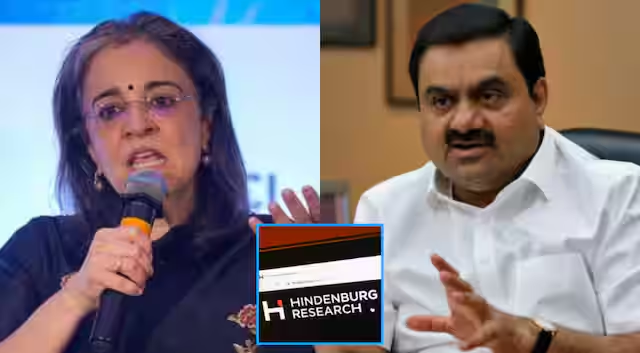

In a video statement released today after Hindenburg’s revelations the Congress MP made three demands wherein the demand for resignation of SEBI Chairperson Madhabi Buch was prominent. He said that this entire matter should be investigated by the Joint Parliamentary Committee (JPC).

He said, “…As the Leader of the Opposition it is my duty to bring to your attention that there is a significant risk in the Indian stock market because the institutions that regulate the stock market have been compromised. There is a very serious allegation against the Adani Group that share ownership and price manipulation using offshore funds is illegal. Now it has come to light that SEBI Chairperson Madhabi Buch and her husband had an interest in one of those funds. This is an explosive allegation because it alleges that the umpire himself has been compromised. Honest investors across the country have important questions for the government- Why has SEBI Chairperson Madhabi Puri Buch not yet resigned? If investors lose their hard-earned money, who will be responsible- Prime Minister Modi, SEBI Chairperson, or Gautam Adani?… New and very serious allegations have surfaced, Will the Supreme Court once again take suo motu cognizance of this matter? Now it is absolutely clear why Prime Minister Modi is against a JPC investigation into this matter.”

STOCK MARKET BALANCES THE JOLT

A cautious Indian stock market on Monday successfully brushed aside the effects of second round of firing from US short-seller Hindenburg Research at Adani conglomerate with Sensex and Nifty managing to remain under control after high volatility throughout the day.

And while the markets managed to remain unaffected much with the inflammable allegations of Hindenburg’s second report, political circles witnessed innumerable round of attacks and counter attacks all through the day.

Aam Aadmi Party (AAP) Rajya Sabha MP Sanjay Singh criticized SEBI’s investigation into the Adani Group, calling it “baseless and irrelevant,” and urged the Supreme Court to take action. His statement follows allegations made by US short-seller Hindenburg Research against SEBI Chairperson Madhabi Puri Buch.

Singh asserted that SEBI’s investigation was flawed due to the involvement of SEBI Chief Madhabi Buch and her husband Dhaval Buch, who allegedly invested nearly USD 10 million in the same dubious funds under investigation.

CONGRESS DEMANDS SEBI CHIEF’S RESIGNATION

Further, Congress on Monday demanded SEBI Chairperson Madhabi Puri Buch’s resignation and urged the Supreme Court to transfer the Adani probe to the CBI or a Special Investigation Team (SIT) given the “likelihood of SEBI’s compromise”.

The opposition party further demanded to immediately convene a Joint Parliamentary Committee (JPC) to look into what it described as ‘Modani mega scam’ involving the ‘self-anointed non-biological PM and a perfectly biological businessman’.

AICC general secretary K C Venugopal warned of a nationwide protest if their demand for a Joint Parliamentary Committee (JPC) probe was not met. Venugopal criticized Prime Minister for supporting Adani and accused the government of using the Enforcement Directorate to divert attention from the issue. Hindenburg claimed Buch and her husband had undisclosed offshore investments, which they said were made before her SEBI appointment and became dormant thereafter.

“Who will guard the guards?”

Earlier, in a post on X, the , Congress general secretary in-charge Communications Jairam Ramesh mentioned the Latin phrase “Quis Custodiet Ipsos Custodies” which translates “Who will guard the guards?” after shocking revelations of SEBI chief’s name came in second Hindenburg report.

He said that in its statement on the on-going investigations into certain financial transactions of the Adani Group, the Securities and Exchange Board of India (SEBI) has sought to project an image of hyperactivity, stating that it has issued 100 summons, 1,100 letters and emails, and examined 300 documents containing 12,000 pages.

“This must have been very exhausting, but it diverts attention from the core issues involved. Actions matter, not activities,” he maintained.